Vertex Pharmaceuticals stands out with robust profitability and a multitude of growth drivers.

Shielded from issues like inflated valuation, intense competition, or excessive risk, Vertex emerges as a rare gem.

When evaluating growth stocks, few come close to the comprehensive strengths of Vertex.

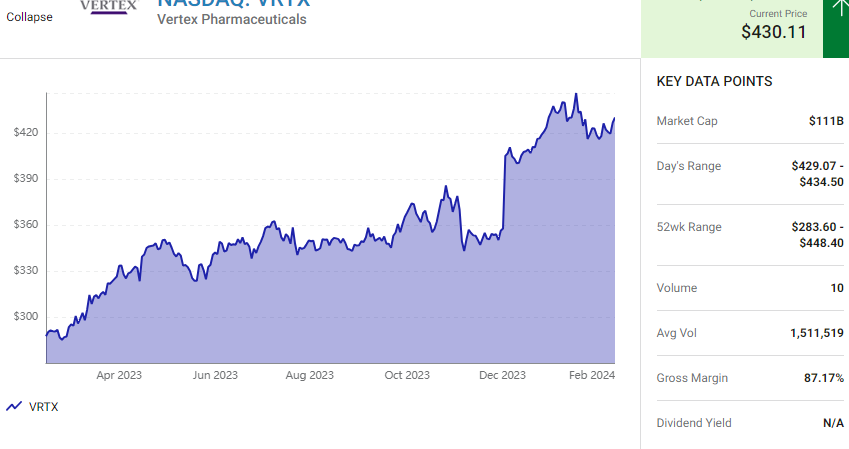

NASDAQ: VRTX

Vertex Pharmaceuticals

Vertex Pharmaceuticals Stock Quote

Market Cap: $111B

Today’s Change: (0.78%) $3.33

Current Price: $430.11

Price as of February 23, 2024, 4:00 p.m. ET

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

Navigating the Investment Landscape:

In the quest for the ultimate growth stock with a $1,000 investment, the allure of high-flying AI stocks was tempting. However, upon closer inspection, the discomfort surrounding potential downsides led to a different choice. Enter Vertex Pharmaceuticals (VRTX 0.78%).

Spotlight on Vertex:

Financial Strength: Vertex, a biopharmaceutical giant, boasts profitability, having generated over $3.6 billion in earnings last year on nearly $9.9 billion in revenue. A substantial cash reserve of $13.7 billion further solidifies its financial position.

Diverse Growth Paths: With a diverse portfolio, Vertex is not limited to one or two avenues. The cystic fibrosis (CF) franchise, including a promising triple-drug combo awaiting approval, underscores its commitment to innovation.

Beyond CF: Casgevy, Vertex’s groundbreaking gene-editing therapy, has garnered regulatory approvals for treating rare blood disorders. VX-548, a pain drug, and Inaxaplin, targeting APOL1-mediated kidney disease (AMKD), showcase the company’s expansive reach.

Mitigating Risks:

Valuation: While some AI stocks grapple with nosebleed valuations, Vertex remains attractively priced. The low price-to-earnings-to-growth (PEG) ratio of 0.58 positions it as an appealing investment.

Competition: Vertex’s dominance in CF treatment, coupled with promising contenders Casgevy and VX-548, minimizes competitive threats. Unique programs targeting AMKD and type 1 diabetes further solidify its market position.

Risk Management: Late-stage programs, such as the vanzacaftor triple-drug combo for CF and VX-548, have undergone de-risking, with phase 3 results already available.

Investment Recommendation:

In a landscape teeming with options, Vertex Pharmaceuticals emerges as an exceptional choice. The positives significantly outweigh the negatives, making it an enticing proposition for a $1,000 investment.

Where to put $1,000 right now to invest:

It pays to pay attention when our research team has a stock suggestion. Ultimately, the market has quadrupled thanks to their 20-year-old newsletter, Motley Fool Stock Advisor. They just disclosed their ranking of the top ten stocks that investors should purchase at this time. and Vertex Pharmaceuticals made the cut, but you could be missing out on these nine additional stocks.

Tesla’s Bullish Outlook: Navigating EV Market Challenges and Embracing AI/Robotics Ventures